Sustainable Web3 Growth in the Post-Hype Era

Internal Playbook: How do I effectively acquire users in Web3 without relying on hype?

Introduction — From Mercenaries to Missionaries

In past bull cycles, Web3 projects often equated “growth” with liquidity mining and airdrops, conflating token emissions with real user acquisition. This model rents short-term attention from mercenary users who disappear as soon as the incentives dry up.

As a founder, you need to recognize that hype can mask a lack of product-market fit. True, long-term growth comes from building something people want to use — not just something they want to trade.

This guide helps you build an organic, self-sustaining growth engine, leveraging Web3’s unique strengths: on-chain reputation, composability, and utility.

1. Reframing the Growth Formula

In Web2, growth is often seen as a funnel: Acquisition → Activation → Retention. In Web3, you should think instead in terms of:

Web3 Growth = Utility × On-Chain Reputation × Composability

- Utility: Users come to solve real problems, not just to farm tokens.

- On-Chain Reputation: Build identity and commitment on-chain so users have real “skin in the game.”

- Composability: The more your protocol integrates into other systems, the more your growth multiplies.

2. Acquisition Without Hype — High-Quality Users Only

a) On-Chain Behavioral Targeting

Rather than casting a wide net with airdrops, use on-chain analytics to find real users with demonstrated behavior. Tools like Dune Analytics or Nansen let you identify wallets that already interact with similar protocols.

Tactics:

- Competitor analysis: Target users active in competing protocols but dissatisfied or underserved. Use Web3 ad platforms or even wallet messaging (e.g., Blockscan Chat).

- Vampire integration, not just yield farming: Don’t lure users only with high APR — offer better UX, lower costs, or real utility so they migrate naturally.

- Behavior-gated incentives: Adopt models similar to RabbitHole, where users must complete defined on-chain tasks to earn rewards. This filters out speculators and rewards genuinely engaged users.

b) Integration as Distribution (Composability Growth)

Your growth ceiling is how many other protocols integrate you — not how many people you directly market to.

Tactics:

- Build developer-first: Make your protocol modular, with SDKs and APIs, so other DApps can embed it easily.

- Use shared pools and composable liquidity: For example, wallet projects become the “wallet of choice” within multiple dApps, or a DeFi protocol integrates with DAO treasuries.

- Look at models like Safe (Gnosis Safe): Rather than chase retail users, they focused on becoming the standard for DAOs and treasury management. That kind of “ecosystem-first” growth is often more valuable than hype.

c) The Inverted Funnel & Community Culture

Instead of trying to onboard millions of shallow users, start with a tight-knit core community and let growth radiate outward.

Tactics:

- Selective onboarding: Consider invite-only access, token or NFT gating, or requiring some contribution (code, content) to join early.

- Build in public: Let your community see you build, struggle, and iterate. This draws in builders and evangelists.

- As one founder put it:

“Web3 isn’t just another channel. It flips the funnel: Community → Trust → Product Use → Evangelism.” (Reddit)

3. Retention & Conversion — From Incentives to Value

a) Improving UX: Remove Onboarding Friction

As one recent academic paper noted, the friction of seed phrases can kill retention. (arXiv)

Tactics:

- Use account abstraction (e.g., ERC-4337) or MPC wallets to allow Web2-style access (email, biometrics) while keeping non-custodial security.

- Offer “easy wallets”: users should feel like they’re logging into a regular app, not wrestling with private keys.

b) Rewarding Contribution Over Capital

Stop thinking of incentives purely as payments for depositing capital.

Tactics:

- Use Retroactive Public Goods Funding (RetroPGF): reward people who build tools, write docs, or educate — not just those who stake or provide liquidity.

- Or use loyalty systems based on NFTs, smart-contract-based loyalty, or reputation. These align long-term value with user actions. (growth-hackers.net)

- Design tokenomics so contributions (governance, content, development) are financially rewarded in a sustainable way.

4. Building Trust & Education

Projects that lean solely on token hype risk failure. Instead, make education and trust the core of your growth. - Educational-led growth: Produce high-quality tutorials, workshops, and guides matched to different levels of user knowledge. (balloon.xyz)

- Use NFT- or token-gated loyalty experiences rather than just hype drops. (growth-hackers.net)

- Build transparency into your roadmap, tokenomics, and long-term vision. Trust is your long-term moat.

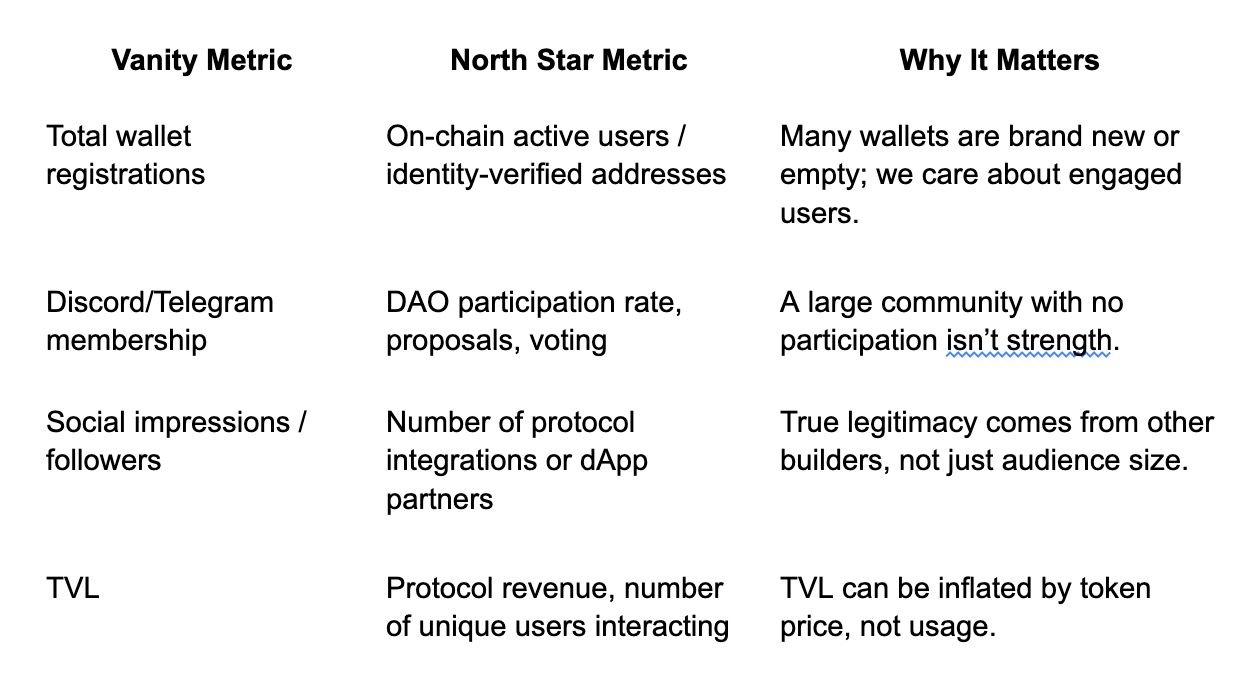

5. Metrics That Actually Matter

Avoid vanity metrics like “wallets created” or “total airdrop claimed.” Focus instead on meaningful KPIs that reflect real growth and health.

6. Putting It All Together: A Growth Roadmap for Founders

- Audit your acquisition: Identify what percentage of your users are purely hype-driven. What happens if token rewards pause?

- Segment and target: Use on-chain data to find your high-potential users and engage them with meaningful utility.

- Design integration: Make your product composable so other protocols can embed it — this multiplies your reach.

- Reduce friction: Lower technical barriers to adoption (account abstraction, better UX).

- Reward contribution: Structure incentives not around capital only but around long-term contribution.

- Educate and build trust: Invest in content, transparency, and community.

- Focus on real metrics: Track north star indicators, not vanity ones.

- Iterate: Run experiments, measure deeply, and constantly refine.

Conclusion — Sustainable Growth Wins

As one Reddit voice summed it up:

“Marketing in Web3 isn’t about growth hacks, it’s about building trust from scratch.”

By moving away from pure speculation and building a growth engine rooted in utility, reputation, composability, and trust, you set your project up not just to survive the next bear, but to thrive in any cycle.

This isn’t fast money. It’s timeless value.